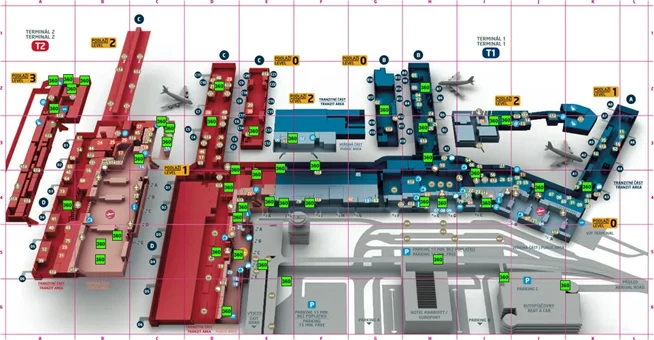

It’s a complicated answer because our lives are complicated and not everyone is in the same situation. So use this chart as a guide.

First, think about your job. If you’re happy and secure, you’ll need less. If you are worried about a layoff or planning to quit, you’ll need more. And in the latter case, it may be more than you think.

Next, think about your lifestyle. How much can you realistically cut back on? Many expenses are controllable, but many are not, like your mortgage, car payments, debt payments and others that you may not be able to scale back as much as you think. The more you can control your expenses, the less we recommend you’ll need.

Lastly, how much do you have in other assets? Do you have a liquid stock portfolio or other liquid assets (i.e. not home equity or a 401k) that you could draw upon in an emergency?

The point of an emergency fund is to hit that sweet spot of having a cushion for the unexpected, but also not over saving in investment vehicles that don’t earn much interest and losing out on the opportunity for your savings to grow.

There is also an element of personal preference and willingness to take risk in deciding how many months belong in your emergency fund. Some may look at these guidelines and then go a little higher or lower depending on their individual risk tolerance. That’s OK.

Wherever you land, liquid emergency funds should be in a money market account or bank certificates of deposit. You’ll pay a penalty if you break the CD early, but since this is for emergencies only, hopefully that’s not the case very often.

If you’d like to discuss your emergency fund we would be happy to provide a free consultation. Just click on the link below.