A guest blog by Joanne Kuster

Everybody lives “paycheck to paycheck?”

Well, not everybody, but survey data shows 8 out of 10 of us routinely do. Yes, we’re more concerned with today’s expenses rather than tomorrow’s nest egg. Oh, we know we should save. But it’s so easy to get caught in “keeping up with the Joneses” that we forget how much we’re spending (and giving up) to do it. It’s not easy to curb that instant gratification or change our financial habits, especially if your partner has a spending appetite too.

Being in sync financially can be a lifelong juggling act for couples – it’s easy to make mistakes and hard to avoid arguments. Here’s how to start fixing seven common money mistakes now:

1. Spending in secret?

Ever hide charges from a shopping spree or a casino weekend with buddies? Do you know how your partner spends, even if it’s fun money? A national survey funded by CESI Debt Solutions revealed 80% of married couples won’t tell partners about some spending, yet 73% said it wasn’t acceptable to spend $100 or more without telling your partner.

Start Your Fix: It’s time to work out whether it’s “your” money or “our” money, rank your financial priorities as a couple, and blend your wants and needs. Hiding purchases or debts, having secret bank accounts, or getting credit cards in only one name signals trust issues. This is a good reason to order your credit report annually, which you can do free here.

2. Living for the moment, with no safety net?

Have any last-minute spending you can’t remember this paycheck? Aw, come on. Most of us do. Did you forget those souvenirs the kids wanted, grabbing gourmet snacks for an impromptu gathering, or the after-work drink that turned into dinner? These unexpected purchases should make it into your budget via a miscellaneous or “fun money” category or something.

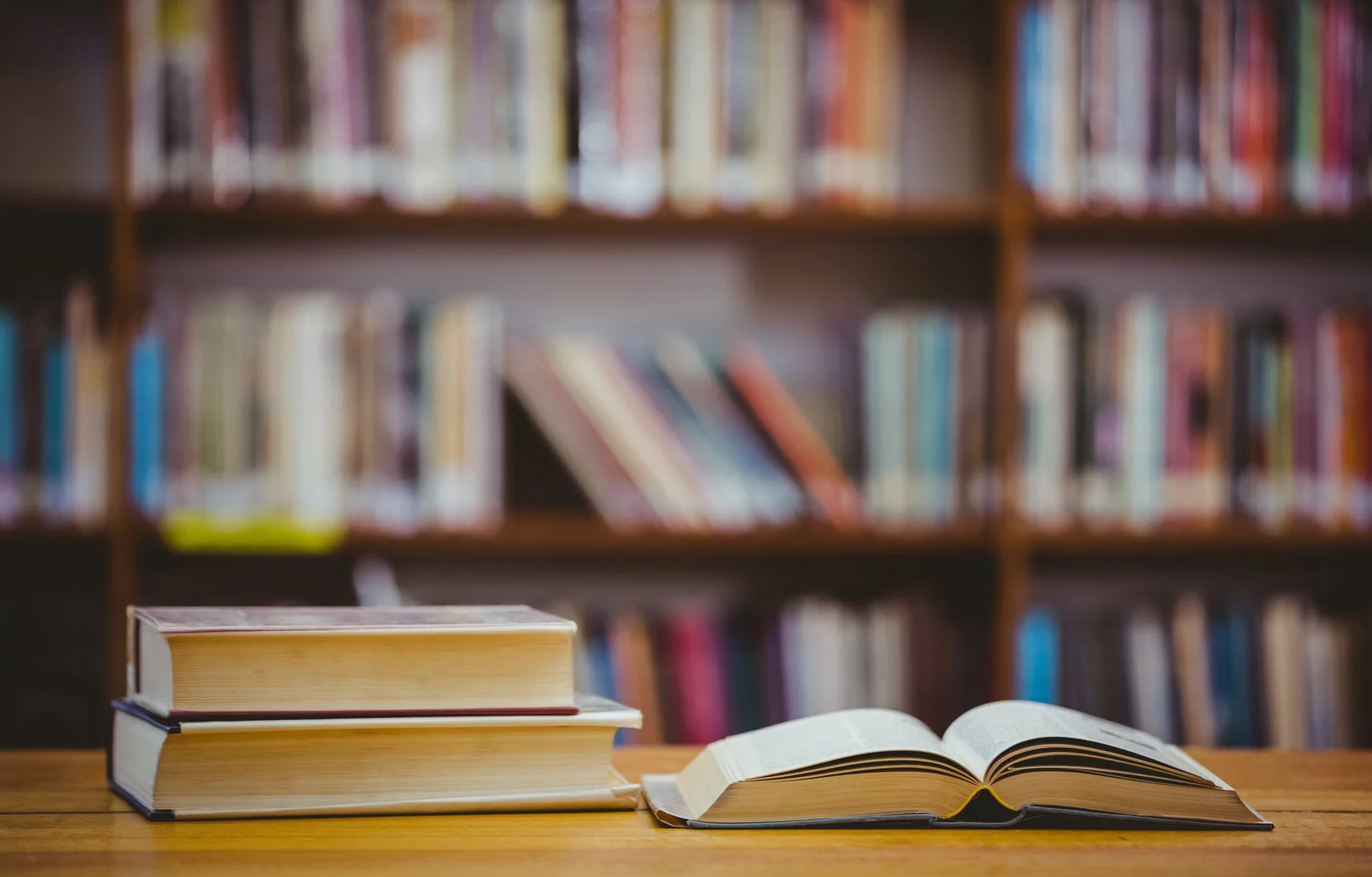

Start Your Fix: Many of us don’t know exactly how much we spend routinely on small or last-minute purchases. It’s time to make a budget, or spending plan, and get the big picture. Think about your wants and needs, then list the categories where your money goes. Be sure to include amounts for emergencies, fun and saving to strengthen your safety net. Find a free template here.

3. One person is the financial workhorse?

Having one partner shoulder the financial load may be convenient or even efficient, unless something happens to the workhorse. It’s not so unusual that one person prefers to do financial tasks such as researching large purchases or investing. But create a back-up plan so both of you (maybe the kids too) know what to do should an emergency arise and the financial taskmaster is not available.

Start Your Fix: Take an inventory of who does each financial chore, like budgeting, paying bills, investing, filing receipts, figuring taxes, researching insurance, etc. Make sure each partner knows the financial institutions, account balances and contact info. Keep a common spreadsheet updated, and establish a periodic touch-point (like monthly).

4. Different goals, no money harmony?

You want a vacation, he wants a new car, the kids want new cell phones. Your budget points to compromise, but you can’t see how?

Start Your Fix: When you can’t have it all, family money talks can be a good solution. First, choose the right time and place (Hint: it’s not late at night when you’re exhausted or during the Saturday football game). Realize your money conversations are emotionally charged, so start by considering each person’s money personality and background – spender or saver – and recognize your views can differ. Listen to really hear what’s important to everyone. Let all suggest solutions to try. Reduce your angst by doing money talks often and routinely.

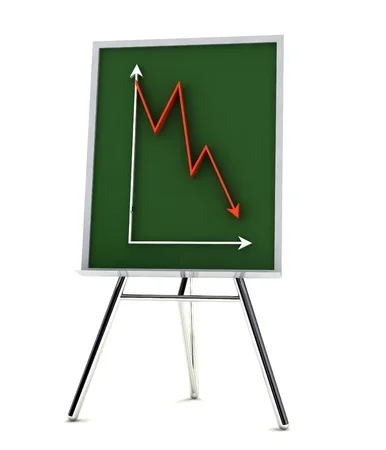

5. Building debt, not wealth?

Most of us use credit. Student loans, car loans, mortgages and revolving credit card balances keep many in a cycle of making monthly payments – which can include hefty interest or finance fees. Unfortunately that leaves little spare cash for building up a nest egg. You think you’ll save later, but you can’t break the cycle?

Start Your Fix: Start small, think big – save automatically. The earlier you can find ways to start a savings stash, the more the magic of compound interest works in your favor. Even small amounts add up! Try opening a savings account for each goal (college, new car, vacation). Use auto-deposit to save money every paycheck. Try an incentive site.

.

6. Late, forgetful or disorganized?

Your credit card bill got buried in mail, and you overlooked the due date? You planned to save last month, but you didn’t get around to opening that savings account? Life gets busy; finances get ignored. Months pass, and it’s overwhelming to get organized?

Start Your Fix: Financial procrastination costs you in time, frustrations and extra fees. Start by putting your financial to-dos on auto-pilot: direct deposit your paycheck, make a monthly auto-deduction to savings, use online bill-pay and auto-pay, get electronic statements, use email reminders for deadlines like filing taxes. As you might expect, there are apps for that. Start by checking with your financial institution to see what’s offered to customers at no charge.

7. Memory failure, no backups?

Yes, life gets busy…so financial paperwork is often tossed in the “to-do-later” pile for months. And, we fail to write down transactions, assuming “surely I’ll remember that,” right? Wrong.

Good recordkeeping means written documents, dates and receipts – because the IRS (Internal Revenue Service) won’t let you rely on memory. Nor does an accident, flood or other natural disaster give you time to gather records before striking.

Start Your Fix: Get financially organized and maintain a filing system – you’ll thank yourself over and over. Over the years you’ll likely go through several computers, so make sure you can reliably access old backup files. Establish a place to collect incoming financial items, maintain a to-do checklist with deadline dates, safely stash financial docs (paper copies) you’ll need later, and reduce your financial clutter. Don’t know what to keep and what to toss? Here’s a list.

Joanne Kuster, a financial educator and entrepreneur, writes the www.MoneyGodmotherBlog.com and creates products to help organizations educate consumers on personal finance topics.

IMPORTANT

The views expressed represent the opinions of the author and are subject to change.

These views are not intended as a forecast, a guarantee of future results, investment recommendation, or an offer to buy or sell any securities.

The information provided is of a general nature and should not be construed as specific investment advice or to be providing investment, tax, financial or legal advice or service to any person.

Additional information, including management fees and expenses, is provided on Cottage Street Advisors’ Form ADV Part 2, which is available upon request.