With the 4th of July celebrations in the books, family vacation season is in full swing! School is out and well, most kids are in no mood to learn. So here are 5 simple ways to sneak some learning and skill building into the family summer vacation.

1-- Put the kids in charge of navigation with an old school Rand McNally paper map. Yes, phones, GPS and digital maps are pretty much ubiquitous, but map reading and navigation is a skill that helps with a general sense of direction, decision making, attention to detail and inevitability, recovering from a mistake. You're on vacation, so taking the long way probably isn't that big of a deal. They may also discover features and landmarks of the surrounding area that they might not know existed and may want to explore further.

2-- Put the kids in charge of the ice cream budget. Sure, there's something special about going to the ice cream shoppe and the smell of fresh waffle cones, but if you're in a rental unit or a suite with a freezer, they may be surprised to learn how many ½ gallons they could buy for the equivalent budget of a trip or two to the ice cream shoppe.

Maybe let them keep the leftover budget? Doing so would help reinforce budgeting techniques, spending trade-offs and prioritization, skills we all need whether we are on vacation or not.

3-- Put the kids in charge of one evening of family activity that doesn't involve electronics or screen time. If you go in with a plan for at least one night for a family activity with no electronics or screen time, you may find that you get some excitement heading into the activity rather than the inevitable “do we have to” attitude. Having to negotiate, plan and then participate in the activity may also lead it to becoming a regular activity rather than a one off.

4-- Turn the trip to the museum into a scavenger hunt with a trip to the gift shop as a reward. Kids eyes typically roll at even the slightest mention of museum-going. But if you do little bit of advanced scouting and identify 8 or 10 items or spots that the kids need to find or questions that they need to find the answer to, they are much more likely to be engaged as they traverse the museum. And since a trip to the gift shop is all but certain, make it the reward for having completed the scavenger hunt.

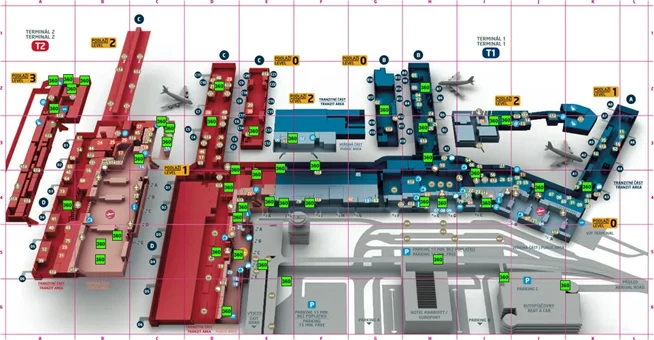

5-- Have the kids navigate the airport. If you've got a plane change layover, have the kids read the monitors and figure out where to go. For all but the seasoned travel warriors, airport navigation can be tricky.

If they make a mistake, like reading the arrival screen instead of the departure screen and you have time to work through the mistake, do it. The experience will help with problem solving, navigation and getting comfortable getting around the airport. Then when you land, put them in charge of finding where the bags come out as well as getting out of the airport or to the car rental, both of which can be non-trivial matters in most airports.

Family summer vacations create all kinds of memories and with just a little bit of effort, we can sneak some skill building in there as well.