Periodically, J. Bradford Investment Management publishes updated commentary, research, analysis and economic viewpoints. This work represents the views, insights and analysis of Jason Haviland, President and Chief Investment Officer at J. Bradford Investment Management.

We'll dig into all the details below, but here is a summary:

The disclosures at the bottom of this blog post are particularly relevant for this material. Let us know if you have any questions.

O.K. Let's jump in!

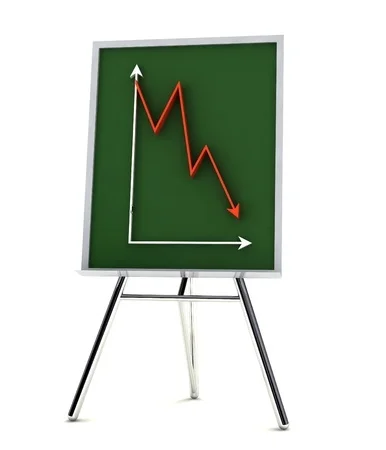

First, let's look at our domestic stock markets. The Dow Jones Industrial Average, the S&P 500 and the NASDAQ are all at or near record highs and have generally been on an upward trend for nearly eight years.

Assuming no major swings, March 9th 2017 will be the eighth year anniversary of this bull market. If you have a 401(k) and have been invested for the last decade, it’s been quite a ride. If you stayed the course, you saw your balance take quite a hit in 2008, but then it very likely came back rather nicely with the upswing in markets across the globe.

And if you're relatively young and started investing anytime after the Spring of 2009, you've only ever seen your balance climb steadily upward. Markets have been very positive for many years, but markets do not move forever upward.

So the big question on everyone’s mind is: Will the U.S. stock market climb higher yet? It might. And if it does, it will likely be driven by some combination of:

1. The health of the U.S. economy

2. A continued rise in corporate earnings

3. Continued historically low interest rates

4. The attractiveness of the U.S. market compared to other developed markets.

Let's look at how these factors may impact the market and the likelihood that their impact will be a positive one.

Let’s start with the first two factors, the U.S. economy as measured by GDP and corporate earnings. These two elements have been very impactful historically in driving stock market performance.

I can absolutely envision a scenario where the U.S. economy continues to grow and potentially even breaks out of the slow growth cycle that it has been in for many years. Some combination of the momentum already underway in the economy and pro growth policies in Washington could set the stage for this to happen.

But the other side of that coin, limits on growth (such as restrictions to selling in international markets) and weakness or very tepid growth in the U.S. economy, are not unrealistic outcomes either. There is some risk that the incoming administration may take an action with unintended consequences that negatively impacts growth and earnings in certain sectors or even across the board.

Investment markets are often driven by expectations of what will happen in the future, and so far, the stock market believes that the grass is greener and that a negative, economic contraction scenario won't happen, which is probably a good thing. We'll be watching this closely.

And it's also possible that we could see more of what we've seen for the last several years. That is, things are generally pretty good for most, but some sectors that don’t perform well, particularly those in political cross hairs. Overall, we may see conditions not really deteriorating, but not really improving either. Things are just good.

Whatever happens, we believe that it is important to assess if there is a commensurate and appropriate reaction and absorption of that information in the stock market, which gets reflected in pricing. If the market is priced as if we are on a high growth path (which you could argue that it is now), but we are actually on a slow growth, neutral or downward path, that could be problematic. We're watching that balance closely.

Next, item #3, our low interest rate environment. We have had low, very low, zero and in some parts of the world, negative interest rates for an extended period of time. Such a long period in this low interest rate environment is relatively unprecedented in financial history. So, when we look at historical valuation measures for insight, the interest rate regime at the time of the analysis is an important factor for comparison. One problem we have now is that we don't have many equivalent historicalperiods like the one we are in now to analyze for comparison.

So how might this low interest rate environment be distorting prices? One simple explanation of the increased inflow of capital to the stock market over the last several years is that because interest rates are so low it just doesn't make any sense to earn half or a quarter of a percent in a CD or 1% on a bond, so investors are investing in stocks instead. Instead of bonds, they are buying stocks that are perceived to be safer (such as utilities) and that generate income (such as dividend stocks). I believe that there is some truth to that assertation and that if interest rates remain abnormally low, the stock market will be seen as an alternative, even if it is a quite imperfect and much, much more risky one.

Lastly, #4, our relative position to the rest of the developed world. In some sense, all stock markets worldwide compete for investment dollars, with investors making determinations as to where they can achieve the best return. If the world economy remains generally stagnant or certain key areas such as Europe start to experience contraction or even just very slow growth without full-blown recessions, it might be the case that the U.S. benefits from simply being the most attractive choice against a backdrop of mediocre choices.

Similar to individual winners and losers in the U.S. markets, there will be individual winners and losers in international markets as well. Most immediately, we’ll face the implications of Brexit, OPEC price controls, the delicate Chinese economy and potential fall-out from the financially troubled members of the Eurozone. As those implications unfold, international investors may judge the U.S. markets to be a better option in the short to medium term.

I believe that all four of these factors have been contributors to our current sustained bull market and some combination of them may drive the market higher, but it's not entirely clear that they will all be pushing upwards as they have been recently, especially interest rates.

So let’s dive a little deeper into interest rates. The Federal Reserve has recently signaled a willingness to raise interest rates. In addition, economic conditions also support increasing rates. As such, interest rate increases from the Federal Reserve in the short to medium term seems very, very likely.

Since bond prices move inversely to bond rates, that means that the prices and values of all our bond holdings in mutual funds and ETFs will likely decrease.

We are likely entering a tough stretch for bonds. However, we should not lose sight of the strategic reasons we hold bonds in the first place – income, diversification, reduced volatility and over the long term -- better risk adjusted portfolio returns. In this environment, individual bonds and bullet maturity shares have some advantages. Here too, we will be monitoring the markets closely.

We would be remiss if we didn’t also consider the political implications of the recent election.

In this area we have a tempered and measured view. Until we get back into the full legislative session, the market is reacting to what it thinks the current administration will do. Ultimately the market will move based on what the administration actually does vs. what they’ve said they would do during the campaign.

Yes, they have a legislative plan, but legislation is complicated and special interests are as powerful as ever in DC, so we’ll know a lot more in the Spring once we see how all the competing interests line-up and after the early executive orders actually get issued. That is, we’ll see what actually happens.

Whew, that was a lot. Or maybe you just jumped here to the bottom line...fair enough. So what does all that mean for our investment portfolios?

Here are our five key takeaways:

- U.S. stock market performance and portfolio performance may be mixed and even diversified portfolios may see more volatility than usual. However, we still believe that it will be more important than ever to hold a diversified portfolio that is periodically rebalanced and potentially tilted towards investments that will perform well in the more likely scenarios.

- We believe that an increased cash holding is warranted. We believe that the market forces discussed here will push and pull against each other over the course of 2017, more so than in 2016, and when combined with potential for geo political instability and less ability to use bonds as a cushion, we’ll want higher cash holdings.

- Sector, smart beta and individual security selection will be important investment lenses for 2017, which we intend to use and pursue.

- We expect increased volatility for the short to medium term that may create opportunities for long-term value buys.

- Interest rates will likely rise in the short to medium term and inflation may follow. Investments that move inversely to rates will be under pressure in the short to medium term and investments that rise during periods of inflation may be warranted.

----------------------------------------------------

PLEASE REMEMBER:

- This material is provided as of December 2nd, 2016 and readers should bear in mind that investment and economic conditions can change very rapidly and that changes or developments subsequent to that date may drastically alter the validity of this analysis.

- There are forward looking statements in this analysis and these statements should not be construed as a prediction or guarantee of what will happen.

- Investing and investment management involves risk, including the loss of your initial investment or any investment gains.

- Past performance is no guarantee of future results.

- This generic information is provided for educational purposes only and should not be construed as a recommendation for any individual to take a specific action.

- Please invest prudently and seek professional help from a financial advisor, investment manager, accountant, lawyer or other professional on matters that you are unsure of or that are unique to your personal circumstances.

- Financial planning and investment management services provided by J. Bradford Investment Management, Nashua NH.